Life’s simple rhythm: salary in, expenses out, makes us feel invincible. But what happens when that rhythm suddenly stops? If you’re gone tomorrow, how will your family survive without your regular income?

Term insurance isn’t just about paying off a mortgage or funding kids’ education; it can preserve your family’s everyday life. That’s where income-replacement term insurance steps in, transforming uncertainty into steady security.

TL;DR

- Income-replacement term insurance pays regular installments instead of a lump sum.

- It assures your family of continued income to meet living costs, EMIs, and lifestyle.

- Most Indians are underinsured: average cover is only ~3× annual income, vs the recommended 10–15×.

- Human Life Value (HLV) and needs-based calculations help estimate cover.

- Structured payouts bridge financial gaps better than lump sums.

- Digital plans make it easy to customise payouts and buy remotely.

What Exactly Is “Income Replacement”?

Your income fills three financial buckets:

Essentials: Groceries, rent/EMI, school fees, utility bills

Aspirations: Vacations, gadgets, lifestyle comforts

Future: Kids’ education, emergency fund, spouse’s retirement

If that income stops suddenly, those buckets empty quickly. Income replacement ensures your family receives salary-like payouts even in your absence.

How it works in term insurance:

- Instead of a single lump sum, your family receives monthly or annual income.

- Some plans allow combinations — e.g., 40% upfront to clear loans + the rest spread out as income.

- Inflation-linked payouts can rise 5–10% each year to match rising living costs.

Example: If your family needs ₹1 lakh/month for 15 years, that’s ₹1.8 crore. Add home loan + future goals − current savings. That’s your income-replacement cover requirement.

The Reality: India Is Underinsured

Most Indians believe 10× income is enough. In practice, the average cover is just ~3× income. Families may survive the first year with the lump sum, but financial stress builds over time. Income-replacement term plans solve this by giving predictable monthly support for years — not just an upfront cheque.

What Makes Income-Replacement Term Plans Unique?

- Salary-Like Flow

Monthly payouts align with how families spend and budget. - Option to Combine Lump Sum + Income

Close a home loan upfront and still receive steady payouts to run the household. - Inflation Protection

Payouts can increase annually to match rising school fees, fuel, and healthcare. - Budget-Friendly Premiums

Since payouts are staggered, premiums can be lower for the same protection level. - Behaviour-Safe

A ₹1 crore lump sum is hard to manage emotionally and financially. Automated payouts ensure the money lasts. - Stronger Protection With Riders

Add Critical Illness, Accidental Death, or Waiver of Premium for protection that goes beyond death — covering income loss due to illness or disability too.

Estimating How Much Cover You Need

- Income Multiple Rule → 10–15× annual income

- HLV (Human Life Value) → Present value of future income minus future expenses

- Needs-Based Approach → (Living expenses × years of support) + debts + goals − savings

Always round up to avoid inflation risk.

How Different Payouts Work in Practice

| Payout Type | Example Structure | Total Family Receives | Pros | Cons |

|---|---|---|---|---|

| Lump Sum | ₹1 crore upfront | ₹1 crore | Immediate liquidity | Risk of mismanagement |

| Monthly Income | ₹60,000/month × 15 years | ~₹1.08 crore | Salary-like flow | No large upfront cash |

| Combo | ₹40 lakh upfront + ₹50,000/month × 15 years | ~₹1.3 crore | Liquidity + stability | Slightly higher premiums |

| Inflation-Linked | ₹50,000/month growing 10% yearly | ~₹1.6 crore | Keeps pace with rising costs | Higher premiums |

Real Experiences That Paint the Picture

Case 1: Mumbai — Lump Sum, Short-Term Survival

Ramesh’s family received ₹1 crore in one go. But three years later, loans + emergencies + poor investment decisions left almost nothing.

Case 2: Bangalore — Income-Replacement Stability

Rahul’s family received ₹40 lakh upfront to close home loan + ₹70,000/month for 15 years. Their lifestyle didn’t collapse — bills, fees, and EMIs remained on track.

Case 3: Court-Style Compensation Logic

Courts calculate compensation using future income × working years left — not lump sum sentiment. That mirrors income-replacement logic.

The difference is clear: lump sums solve problems today, but structured payouts protect dignity tomorrow.

Why the Momentum Is Building

- Global adoption of income-protection insurance

- Digital-first Term Insurance 2.0 with custom payouts

- Young earners and single-income families preferring monthly support over large cheques

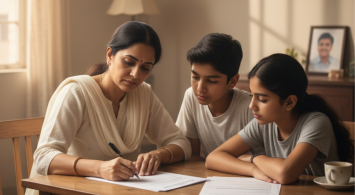

A Parent’s Perspective

Education plans and legacy plans protect the future. Income replacement protects the present — lights on, fridge stocked, kids in school. It keeps everyday life steady when tragedy strikes.

FAQs

Who benefits most?

Sole earners, high-EMI households, single parents, or anyone whose family relies on monthly cash flow.

Monthly payout or mix?

Go for a mix if your family needs upfront liquidity. Otherwise, monthly income works best.

What about inflation?

Choose inflation-linked income if dependents will rely on payouts for 10–20 years.

How often to review coverage?

Every 3–5 years, or after major life events.

Conclusion

If education and legacy plans secure your family’s future, income-replacement term insurance secures their present. Think of it as extending your monthly salary beyond your lifetime — a promise that your family’s lifestyle won’t collapse if you’re not around.