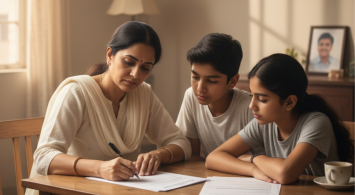

Loans are now part of everyday Indian life—whether it is a 20-year home loan, an education loan for children, or personal credit. These debts help us build assets and fulfil dreams, but they also create long-term obligations. The reality is simple: if the borrower is no longer around, the EMI does not disappear. It shifts to the family. Term insurance for loan cover ensures your loved ones inherit your home, car, or education—not the burden of repayment.

TL;DR

- India’s retail credit has surged; the average home loan size is ~₹30 lakh nationwide, higher in metros.

- Without cover, outstanding debts transfer to family members or co-borrowers.

- Term insurance for loan cover clears EMIs instantly—affordably (e.g., ₹50 lakh loan covered for under ₹500/month for a healthy 30-year-old).

- Options: a dedicated reducing-cover loan protection plan, or a regular term plan with higher sum assured.

- Real-world case: A borrower’s ₹1.5 crore term policy cleared his ₹50 lakh loan, saving his parents from losing their home (Future Generali Life Insurance).

What Is Loan Cover in Term Insurance?

A loan cover plan is a type of term insurance designed to protect against debt liability. If the insured passes away, the policy pays out an amount equal to the outstanding loan, ensuring the family keeps the asset—house, car, or education—without distress sales. Co-borrowers (spouse, parents, children) are not left to manage EMIs alone. The legacy is clear: property, not liability. Loan cover can be standalone (decreasing cover aligned with EMIs) or integrated into a larger term plan.

Why Loan Protection Deserves Its Place in Your Plan

- Home Loans: A Multi-Decade Commitment

Home loans run 15–25 years on average. Without cover, families may face foreclosure or forced sale in case of a tragedy. With loan cover, the bank is repaid and the house remains secure. - Education Loans: Protecting Futures

Many parents co-sign education loans. If the primary earner dies, the burden shifts to children. Loan cover ensures studies continue without disruption. - Smaller Loans: Not as Small as They Seem

Car loans and personal loans may be shorter in tenure but can still strain family budgets. Covering them avoids additional stress during already difficult times.

Case Study: Satwik’s Story

Satwik, a 35-year-old entrepreneur, took a ₹50 lakh home loan. Alongside, he purchased a ₹1.5 crore term insurance policy with coverage extending through his loan tenure. When Satwik passed away unexpectedly, the payout cleared the home loan in full. His elderly parents kept the home without financial distress. The same cover also gave them additional funds for living expenses. This example illustrates how combining loan protection with income replacement can safeguard both assets and lifestyle.

Structuring Loan Cover: Which Option Works Best?

| Option | How It Works | Best For | Drawback |

|---|---|---|---|

| Home Loan Protection Plan | Coverage reduces as loan balance reduces | Borrowers with a single loan | No coverage beyond the loan |

| Term Plan (Loan + Income) | Fixed sum assured covering debts + expenses | Families with multiple needs | Higher premium than reducing plan |

| Bundled Bank Loan Insurance | Sold at loan disbursal; premium loaded into EMI | Convenience-focused buyers | Costly and less flexible |

👉 Most financial planners recommend a regular term plan with adequate sum assured (loan + income replacement). It is versatile, cost-effective, and covers more than just EMIs.

With vs Without Loan Cover

| Scenario | Without Loan Cover | With Loan Cover |

|---|---|---|

| Home Loan | Family forced to sell or foreclose | Loan cleared, home retained |

| Education Loan | Burden shifts to children | Cleared instantly, studies continue |

| Car/Personal Loan | Assets repossessed or sold | Assets remain with family |

| Legacy | Debts eat into inheritance | Family inherits only assets |

Regulatory & Product Insights

ICICI Prudential: Flexible sum assured; families can choose lump sum or structured payout to clear loans.

Future Generali / Tata AIA: Offer home loan protection riders that align with loan tenure.

Canara HSBC, Kotak, HDFC Life: Offer both reducing-cover and fixed-cover term plans for different borrower profiles.

IRDAI: Clearly states loan insurance is optional even if banks pressure applicants into purchasing it.

Borrower Experiences

A borrower wrote on Reddit: “The bank insisted on bundled loan insurance. I later discovered I could cancel it during the free-look period.”

Another shared: “Bundled plans cost 2–3× more. A standalone term policy gave me better value and flexibility.”

These real-world stories echo the same insight — standalone term insurance is usually smarter than bundled bank-sold products.

FAQs

Should I buy a separate loan cover policy or increase my term cover?

If you already have a term plan, increase your sum assured to cover both debts and income needs.

Does loan cover reduce as I repay my loan?

Yes, in standalone loan-specific policies. Regular term plans keep the cover fixed.

Can co-borrowers be insured as well?

Yes. Many insurers allow joint coverage so either borrower’s death clears the liability.

Is loan insurance mandatory during loan approval?

No. Banks may push for it, but IRDAI confirms it is not compulsory. Free-look cancellation is available if mis-sold.

What if I repay the loan early?

In a reducing cover plan, cover may end early. In a regular term plan, the cover continues.

Conclusion

Loans build dreams—but they also build obligations. Without insurance, those obligations can outlive you, straining your family. With term insurance for loan cover, EMIs vanish instantly and your family keeps the home, education, or assets you worked so hard to secure. For just a fraction of your EMI—often a few hundred rupees a month—you can ensure your legacy is a roof over your loved ones, not a liability.